.png?width=100&name=White-Box-for-Web%20(1).png)

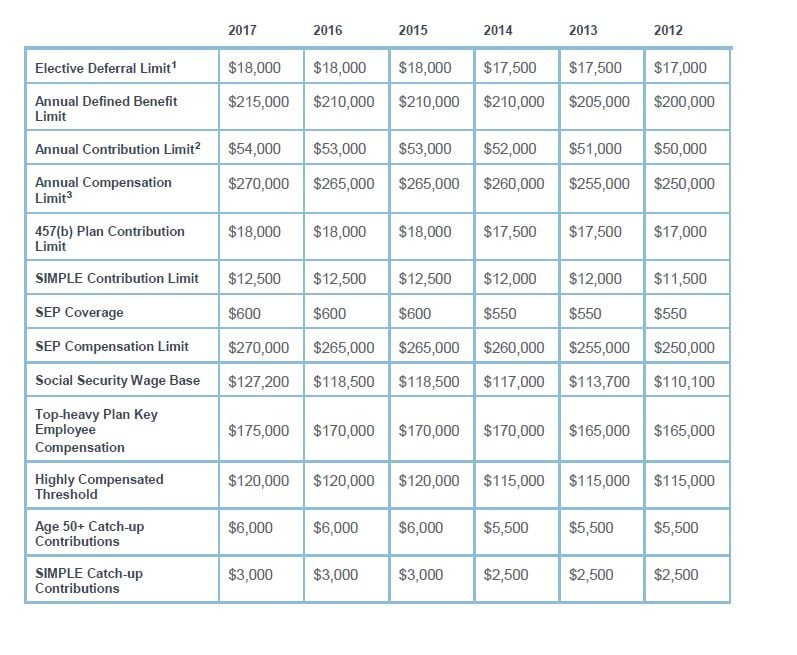

The limits described below are as published by the Internal Revenue Service.

Elective Deferral Limit - The maximum allowable annual pre-tax contribution that can be made by participants in a 401(k) or 403(b) plan under Internal Revenue Code §402(g)(1).

Annual Defined Benefit Limit - The maximum annual benefit that can be paid to a participant under a defined benefit plan under Internal Revenue Code §415(b)(1)(A).

Annual Contribution Limit - The maximum annual contribution amount that can be made to a participant’s 401(a), 401(k) or 403(b) account under Internal Revenue Code §415(c)(1)(A). This limit as applied is the lesser of the dollar limit above or 100% of the participant’s compensation, applied to the combination of employee contributions, employer contributions, and forfeitures allocated to a participant’s account. The Annual Contribution Limit does not include Age 50+ Catch-up Contributions.

457(b) Plan Contribution Limit - The maximum allowable annual total contributions that can be made by the participant and the employer sponsoring the 457(b) plan under Internal Revenue Code §457(e)(15).

Highly Compensated Threshold - The minimum annual compensation level established to determine highly compensated employees for purposes of nondiscrimination testing under Internal Revenue Code §414(q)(1)(B).

SIMPLE Contribution Limit - The maximum annual contribution that can be made to a Savings Incentive Match Plan for Employees (a simplified retirement plan strategy for small businesses) retirement account under Internal Revenue Code §408(p)(2)(E).

SEP Coverage Limit - The minimum earnings level for a self-employed individual to qualify for coverage by a Simplified Employee Pension plan (a special individual retirement account to which the employer makes direct tax-deductible contributions) under Internal Revenue Code §408(k)(3)(C).

SEP Compensation Limit - The maximum annual compensation limit applied in determining the maximum contributions made to the Simplified Employee Pension plan under Internal Revenue Code §408(k)(2)(C).

Social Security Wage Base - The maximum amount of earnings subject to Social Security taxes.

Top-heavy Plan Key Employee Compensation - The dollar limitation under Internal Revenue Code §416(i)(1)(A)(i) concerning the definition of a key employee in a top-heavy plan.

Age 50+ Catch-up Contributions, SIMPLE Catch-up Contributions - The annual dollar limitation under Internal Revenue Code §414(v)(2)(B)(i) or §414(v)(2)(B)(ii) that can be contributed by participants who are or will be age 50 or older during the plan year. These catch-up contributions may be made in addition to the applicable limits described above.

Notes:

1Elective Deferral Limits – 402(g) and catch-ups are based on the calendar year (the IRS tax year).

2Section 415 limits are tested on a plan year basis, based on the plan year end. If your plan runs from July 1, 2016 – June 30, 2017, the annual limitation is 2017.

3 Compensation limits are based on the plan year beginning date. If your plan runs from July 1, 2016 – June 30, 2017, the 2016 limitation should be used.