Brian Montanez, CPC, TGPC, AIF, CPFA

Principal

Introduction

Understanding fees in a defined contribution retirement plan can be a daunting and confusing task that may leave you feeling like an unwilling participant in a shell game. However, it is also the first step towards executing on your fiduciary responsibility (whether under ERISA or state law) to ensure the fees your plan is paying are reasonable.

In this paper, I will break down and explain the five most common models that recordkeepers use to pay plan fees. These five models are:

Common Models

Cost-Based Model

In the Cost-Based model, service providers are directly tying their fees to the specific services they perform. The fees will likely consist of a combination of base fee, per participant fee, and explicit asset based fee, and are often aligned to the specific cost of services. For example:

The Cost-Based model is typically found in unbundled recordkeeping relationships with local/regional third party administrators and separate custodians. This model is typically used for smaller plans, plans with complicated designs, or plans with illiquid or legacy assets. However, the Cost-Based model is becoming more popular for plans with low turnover and high average account balances. Any fund revenue sharing (see Revenue Sharing (Target) Model below, for an explanation of revenue sharing) is typically credited back either to plan participants or used to offset the explicit fees charged by the vendors.

Revenue Requirement Model

In the Revenue Requirement model, fees consist of a stated revenue requirement expressed typically as a percentage of plan assets that the vendor needs to collect. The fees are frequently inclusive of administration, recordkeeping and participant services. Usually, the vendor is indifferent as to payment method (revenue sharing or asset-based charge). The fees are usually paid (at least partially) through revenue sharing payments from the investment products (e.g. mutual funds). The key differentiator for this model is that the vendor needs to periodically reconcile the revenue it receives against the stated revenue requirement. Excess revenue is created back to a revenue credit account or to participants. Insufficient revenue is closed with an explicit charge (usually an asset-based charge paid by participants).

Revenue Sharing (Target) Model

In the Revenue Sharing model, the vendor collects revenue sharing directly from the investment products sufficient to subsidize their recordkeeping and administrative fees. Typically there are no extra fees to the plan sponsor, nor any explicit asset-based fees. This model does not include any periodic reconciliation of revenue relative to the quoted fee or actual revenue received. In this case there is no "excess" or "insufficient" revenu to either return participants or to make up through an explicit asset-based fee. This model can include the creation of a revenue credit account that is funded by a set amount annualy if negotiated with the vendor and the investment menu provides sufficient revenue sharing.

In this model, because the vendor is paid via revenue sharing from the investment products, making fund changes will have a pricing impact that must be considered by the vendor. This will naturally limit investment selection to the universe of revenue sharing funds on the vendor's platform, and any major fund changes (such as changing a target date fund series) may require changes in pricing model in order to implement. Periodic price reductions can be achieved through the use of less expensive share classes, but at some point (i.e. a zero revenue share class) this will make reducing fees more challenging. This model limits the investment universe to only revenue sharing funds and is therefore almost exclusively used in small plans.

Revenue Sharing Plus (Requirement + Target) Model

In the Revenue Sharing Plus model, the vendor collects revenue sharing, but the revenue sharing alone is insufficient to meet their total revenue needs. Therefore, the vendor will charge an additional stated fee (e.g. asset-based fee). These combined fees are inclusive of administration, recordkeeping and participant services. This model provides greater investment flexibility than the Revenue Sharing Model as revenue sharing is not the only way for the vendor to collect their fees. Implementation of this model takes many forms depending on the vendor.

Fund Level Equalization Model

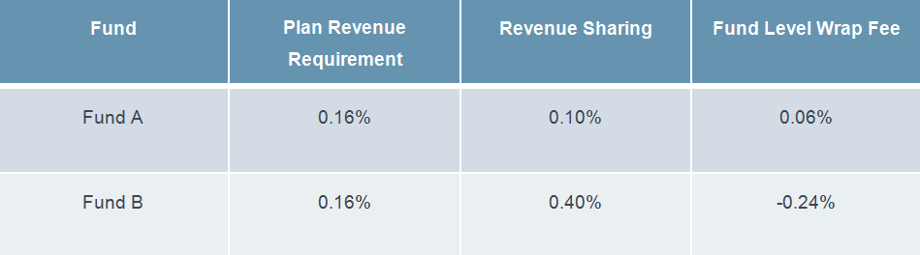

This model is the next generation of Revenue Sharing Plus model. The vendor will have a revenue requirement for the plan (stated as a percentage of plan assets). For each fund in the investment menu they determine whether that fund's revenue sharing provides any surplus or deficit to the stated requirement. They difference between the fund's revenue sharing and the revenue requirement is either charged against, or credited back to, participants in the fund.

Example:

This method is the most difficult operationally because of the number of moving parts and can create challenges with participant communications. However, it is considered by many to be the most equitable way to assess asset-based fees to participants (in plans where the investment menu generates revenue sharing).

Share Class Considerations

Share class is a pricing structure for a mutual fund type of investment. There are often multiple share classes with varying expense ratios, asset minimums, and varying amounts of revenue sharing for the same fund. When considering which share classes to use in your plan, you must first start with the fund's expense ratio and consider any revenue sharing paid by that share class to get to the net expense. The fund with the lowest expense ratio is not always the lowest cost product and share class availability is dependent on the recordkeeper and investment manager.

The client's fee model will dictate to what extent alternative share classes should be considered.

Plan fiduciaries should be on the lookout for opportunities beyond share class adjustments to manager plan expense, particularly with index funds. One index fund, potentially your recordkeepers fund, may have a higher investment management fee than that of another vendor for the same product.

Conclusion

Plan fees and expenses are important considerations for all types of retirement plans. Many of your investment and service related decisions will require you to understand and evaluate the costs to the plan. As a plan fiduciary, you have an obligation under ERISA and/or state laws to ensure that only reasonable fees are paid by your retirement plan. Understanding and evaluating plan fees and expenses associated with plan's investment options and services are an important part of a fiduciary's responsibility.

Information herein is provided for general informational purposes and not intended to be completely comprehensive regarding the particular subject matter. Multnomah Group does not represent, guarantee, or provide any warranties (express or implied) regarding the completeness, accuracy, or currency of information or its suitability for any particular purpose. Receipt of information does not create an adviser-client relationship between Multnomah Group and you. Neither Multnomah Group nor our advisory affiliates provide tax or legal advice or opinions. You should consult with your own tax or legal adviser for advice about your specific situation.

© 2026 Copyright Multnomah Group Inc.