Comprehensive and dedicated personal financial planning service

focused on building a COMPREHENSIVE financial STRATEGY

for every stage of life

We take a holistic approach to our personal financial planning service. We learn about you and your resources and goals to create an individualized strategy addressing where you are now and where you want to be. With a clear view of your specific needs, we can begin building your financial plan.

We take a holistic approach to our personal financial planning service. We learn about you and your resources and goals to create an individualized strategy addressing where you are now and where you want to be. With a clear view of your specific needs, we can begin building your financial plan.

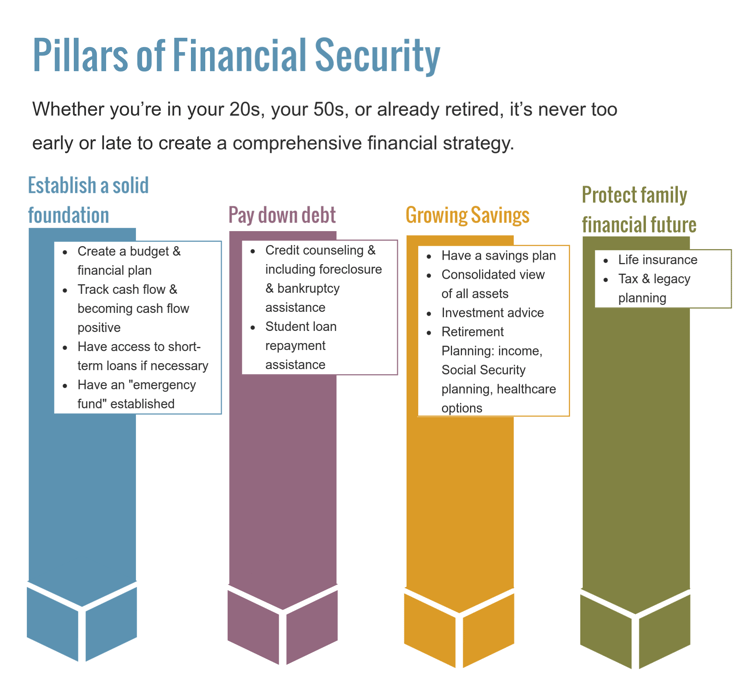

True financial success involves putting together all the individual pieces that make up your personal financial puzzle. Based on your needs, we can create a detailed plan for you that includes the following areas:

A successful plan for your long-term financial wellness is more than your investments and available cash. We will work together with your tax, estate, and insurance service providers to ensure your investment management and financial planning services are on the same path to work together cohesively.

A: Retirement is a major milestone that requires careful planning. The primary consideration should be: how am I going to replace my income in retirement? For most individuals, retirement income comes from a combination of Social Security, pension or 401(k) savings, and personal savings. In some cases, it may be augmented by part-time work. Your retirement income plan should seek to maximize all of your sources of potential income.

But income is only one half of the equation for a successful retirement. You should also be thinking about your retirement expense budget.

To understand whether you can retire, you need to know your living expenses and whether your projected retirement income is sufficient to cover those expenses. Your budget should account for payments for any debts that you may have outstanding (mortgage payments, car payments, etc.) and regular living expenses. It should also account for your projected medical expenses as that is a primary expense for most retirees.

By creating a solid retirement income plan and expense budget, you can evaluate whether you are on track for retirement or need to adjust your plan.

A: We begin each prospective new client engagement with a discovery meeting. The purpose of the meeting is for you to get to know us and understand our philosophy and process. While at the same time, it is an opportunity for us to get to know you better and learn about your financial objectives. We are looking to build a long-term partnership with our clients, and the foundation of this partnership is for you to have clear expectations about what we do and how we do it. You should feel comfortable to ask us questions, and as we share our philosophy and process, we hope to answer any questions you may have about what we do and how it can benefit you. Ultimately, either of us may decide that we are not the right fit to work together, but the goal of the first meeting is to provide an opportunity without any concerns about having to make a commitment.

After the initial meeting, we work with you to set up an online data portal where we can gather information about your financial circumstances to support the initial planning process.

Once the onboarding is complete, we will review the data that is available and follow-up with any questions we may have. Based on this information, we will develop an initial financial plan and schedule a meeting with you to discuss the plan and begin the implementation phase.

Moving forward, we work with you on an ongoing basis to manage your portfolio and to review the financial plan on an annual basis or as needed based on changes in life circumstances. A financial plan is a living document and requires constant maintenance and re-evaluation as your circumstances and goals change.

A: Multnomah Group’s fees are dependent upon a variety of factors and as such, no standard fee schedule applies to all clients. However, Multnomah Group generally charges an explicit annual fee for ongoing investment management services which is generally calculated using a blended percentage rate based upon the applicable percentage fee for the amount of assets in each of the breakpoints listed below:

Assets under management Fees

First $1 million 1.00%

$1 million to $2 million 0.75%

$2 million to $3 million 0.50%

$3 million to $4 million 0.35%

Over $4 million 0.25%

Fees are charged quarterly in advance based upon the market value of the account at the end of the prior quarter.

A: A fiduciary is someone that must act in your best interest. For investment advisors, the Securities and Exchange Commission (SEC) states:

“This means that you have a fundamental obligation to act in the best interests of your clients and to provide investment advice in your clients’ best interests. You owe your clients a duty of undivided loyalty and utmost good faith. You should not engage in any activity in conflict with the interest of any clients, and you should take steps reasonably necessary to fulfill your obligations.”

Most people assume that the financial professionals they work with are going to follow that definition and work solely in their best interests. Unfortunately, not all advisors have to follow the SEC’s definition and the SEC has not done a very good job of helping consumers differentiate between those who serve their clients as fiduciaries and those who don’t.

Within the investment industry, individuals are licensed either as investment adviser representatives or registered representatives.

To make matters even more confusing, many investment adviser representatives and registered representatives use similar titles such as “wealth manager” or “financial consultant.” And in some cases, professionals are registered as both, switching “hats” between serving as a fiduciary, or not, depending on the client they work with and the specific service they are providing.

If you are working with an advisor or evaluating hiring a new advisor, they should be able to clearly state that they will serve you as a fiduciary. Multnomah Group is registered with the SEC as a registered investment advisor and serves our clients as a fiduciary. We are not affiliated with any broker-dealer and have no ability to earn any commissions for selling products. We believe this model reduces conflicts of interest and frees our employees to provide the best possible advice to our clients.

Associate Financial Advisor

Principal

For more information on how Multnomah Group can help you, please provide the information below and you will receive an email with more information about our Personal Advisory Service.

A new area of class action litigation is on the rise - general account fixed annuity products used as cash alternatives in ... Read more

When it comes to managing a retirement plan, most fiduciaries focus on visible fees—recordkeeping, investment management, ... Read more

No upcoming webinars are scheduled at this time. Check back later!

© 2025 Copyright Multnomah Group Inc.