Multnomah Group was founded in Portland, a city with a culture built by artisans who demonstrate added care, passion, and pride in what they craft. That mindset drives us to keep our target on creating forward-thinking, highly-customized plans as unique as the needs of our clients.

We are a 100% fee-for-service independent retirement plan consulting firm. We guide our clients toward better outcomes by navigating around complexities to practical and proven solutions, without outside influences navigating our narrative. Fueled by what is best for plan sponsors and their employees, our focus is on our clients, not our own self-interest.

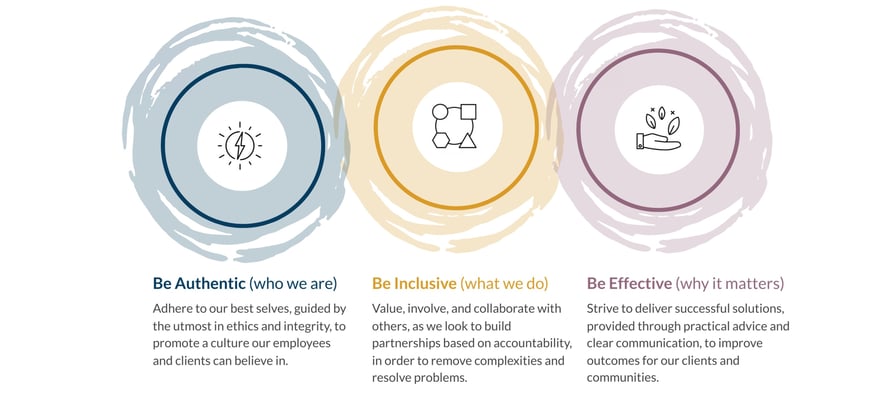

Below we highlight the values of our organization which serve as the foundation for what has allowed us to successfully partner with so many institutions for nearly 20 years. We have an unwavering focus to serve our clients with excellence.

To do so, we strive to:

Multnomah Group is a 100% employee-owned firm organized as an S-corporation with no parent, investor, or affiliate relationships.

In November 2003, founding principals Erik Daley and Scott Cameron launched a company where they could provide independent retirement plan consulting services to employers. Both had been on the vendor side of the industry and recognized the disconnect between plan sponsors and retirement plan vendors, and how, more often than not, vendors focused on what was best for business, not for clients.

In starting Multnomah Group, Erik and Scott wanted to work directly with plan sponsor clients, unconstrained by the limitations of any single vendor platform. They sought investments from family and invested their own capital to create an employee-owned firm.

How an organization structures itself plays directly into how it operates, makes decisions, and serves clients, as well as how it boosts its employees’ performance and creativity. As a plan fiduciary, it’s important for you to know the different structures of institutional retirement plan consulting organizations, the benefits and drawbacks of each structure, and why we feel our way is the most beneficial to you and your participants.

Today, Multnomah Group’s priority is the same as in 2003, to help clients create a world-class retirement plan for their participants without the shadow of conflicts or shareholders. We help plan sponsors understand the responsibilities and navigate the complexities of overseeing their retirement plan. Our annual fiduciary program focuses on a plan sponsor’s fiduciary requirements for investment oversight, vendor and plan management, and plan governance, creating a comprehensive strategy to arm them with the tools and knowledge to have a positive impact on their retirement plan. We do this through a practical approach by focusing on the plan sponsor, their plan, and their participants, not the industry or the vendors within it. We work in partnership with our plan sponsor clients and their benefits, human resources, and finance teams to design and implement a retirement program that aids participants in achieving a successful retirement.

A: Yes. Multnomah Group, Inc. is a Registered Investment Adviser registered with the Securities and Exchange Commission. As such, we are a fiduciary to all of our clients. For our ERISA-covered clients, we serve as a fiduciary either under ERISA 3(21)(A) or 3(38), depending on the preference of the client.

A: Multnomah Group provides comprehensive compliance resources to support plan sponsors and investment committees in meeting their fiduciary and regulatory obligations. Our compliance support is anchored by our Director of ERISA Technical Services, who oversees firm policy on ERISA technical issues and reviews specific compliance matters affecting clients.

Key compliance and regulatory support services include:

A: Multnomah Group is compensated exclusively through direct, fully disclosed fees paid by clients for the services provided. This fee covers all core services, including fiduciary governance, investment advisory, provider oversight, and committee support.

Fill out the form below for more information about Multnomah Group's services

and our experience assisting retirement plan sponsors.

Our team of dedicated professionals bring diverse backgrounds and experience to Multnomah Group.

Together, we are committed to helping retirement plan sponsors create and maintain successful retirement plans.

Our collaborative approach to client service ensures that clients have access to the best resources within our organization.

Managing Principal

Erik Daley is the managing principal for Multnomah Group.

Principal

Scott Cameron is the chief investment officer for Multnomah Group and a co-founding principal of the firm.

Principal

Brian Montanez is a principal at Multnomah Group.

Principal

Charles Warren is a principal and retirement plan consultant for Multnomah Group.Principal

Joe Fleischmann is a principal and retirement plan consultant for Multnomah Group.Principal

David Williams is a principal of Multnomah Group and serves as the director of investment services.

Senior Consultant and Director of ERISA Technical Services

Greg is a senior consultant and the director of ERISA technical services at Multnomah Group.

Director of Vendor Services

Emily Zinn is the director of vendor services at Multnomah Group.Associate Consultant

Becca Dobson is an associate consultant for Multnomah Group.

Senior Manager Research Analyst

Caryn Sanchez is the senior manager research analyst at Multnomah Group.

Client Service Coordinator

Jennifer Tamayo is a client service coordinator for Multnomah Group.

Marketing Manager

Lindsey Knopik is the marketing manager for Multnomah Group.

Chief Compliance Officer / Director of Human Resources

Amy Barber is the chief compliance officer / director of human resources for Multnomah Group.Senior Financial Advisor

Nelson Rutherford is a senior financial planner for Multnomah Group. With more than three decades of financial planning experience, Nelson works with individuals and families on their tax planning, retirement plan design and consulting, and personal financial planning. He has also assisted trustees and sponsors in managing their retirement plan, charitable, institutional, and beneficiary wealth.Investment Operations Analyst

Rona Remoket Warren is an investment operations analyst at Multnomah Group.Investment Operations Analyst

Hailey Cox is an investment operations analyst at Multnomah Group.Investment Analyst

Azzurra Cappuccini is a investment analyst for Multnomah Group.Investment Analyst

Stella Harkness is an investment analyst for Multnomah Group.Associate Financial Advisor

Jake Larson is an associated financial advisor at Multnomah GroupFinancial Planner

Timothy Slevin-Vegdahl is a financial planner for Multnomah Group.

Transitioning your retirement plan from one recordkeeper to another can be a complex and significant undertaking. In this guide, we will walk you through how to navigate the challenges of such transitions while offering best practices to ensure a seamless experience for both plan sponsors and participants.

The retirement plan provider landscape has shifted. Recordkeepers are no longer just administrators—they’re expanding into ... Read more

A new trend in ERISA litigation is focusing on voluntary benefits offered to employees, such as medical, vision, and dental. ... Read more

No upcoming webinars are scheduled at this time. Check back later!

© 2026 Copyright Multnomah Group Inc.