A Review of the five categories of materials

to include in a fiduciary file

Retirement plans are designed to be long-term programs for participants to accumulate and receive benefits at retirement. As a result, plan records may cover many years of transactions. The Internal Revenue Service (IRS), as well as the Employee Retirement Income Security Act (ERISA), require plan sponsors to keep records of these transactions because they may become material in administering pension law.

Considering that the Department of Labor (DOL), IRS, participant, or participant’s legal counsel could come calling at any time, you’ll want to be ready to show your ERISA required documented prudent process.

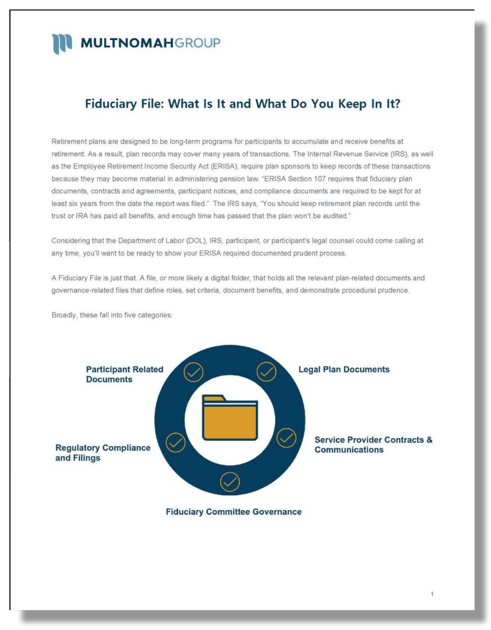

A Fiduciary File is just that. A file, or more likely a digital folder, that holds all the relevant plan-related documents and governance-related files that define roles, set criteria, document benefits, and demonstrate procedural prudence.

Download our short guide covering the broad five categories of materials you should include in your fiduciary file.

For instant access to our guide, please fill out the form below.

© 2026 Copyright Multnomah Group Inc.