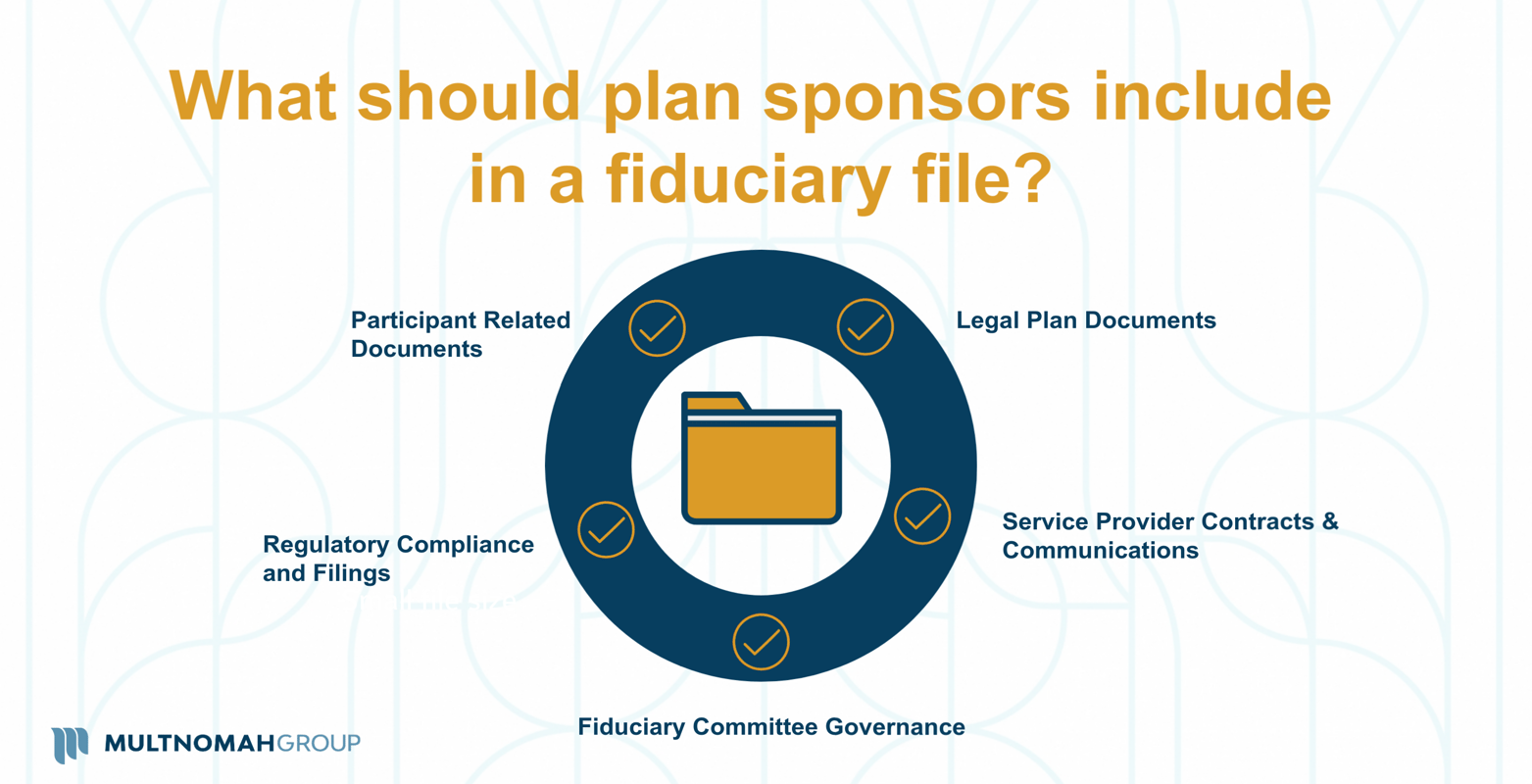

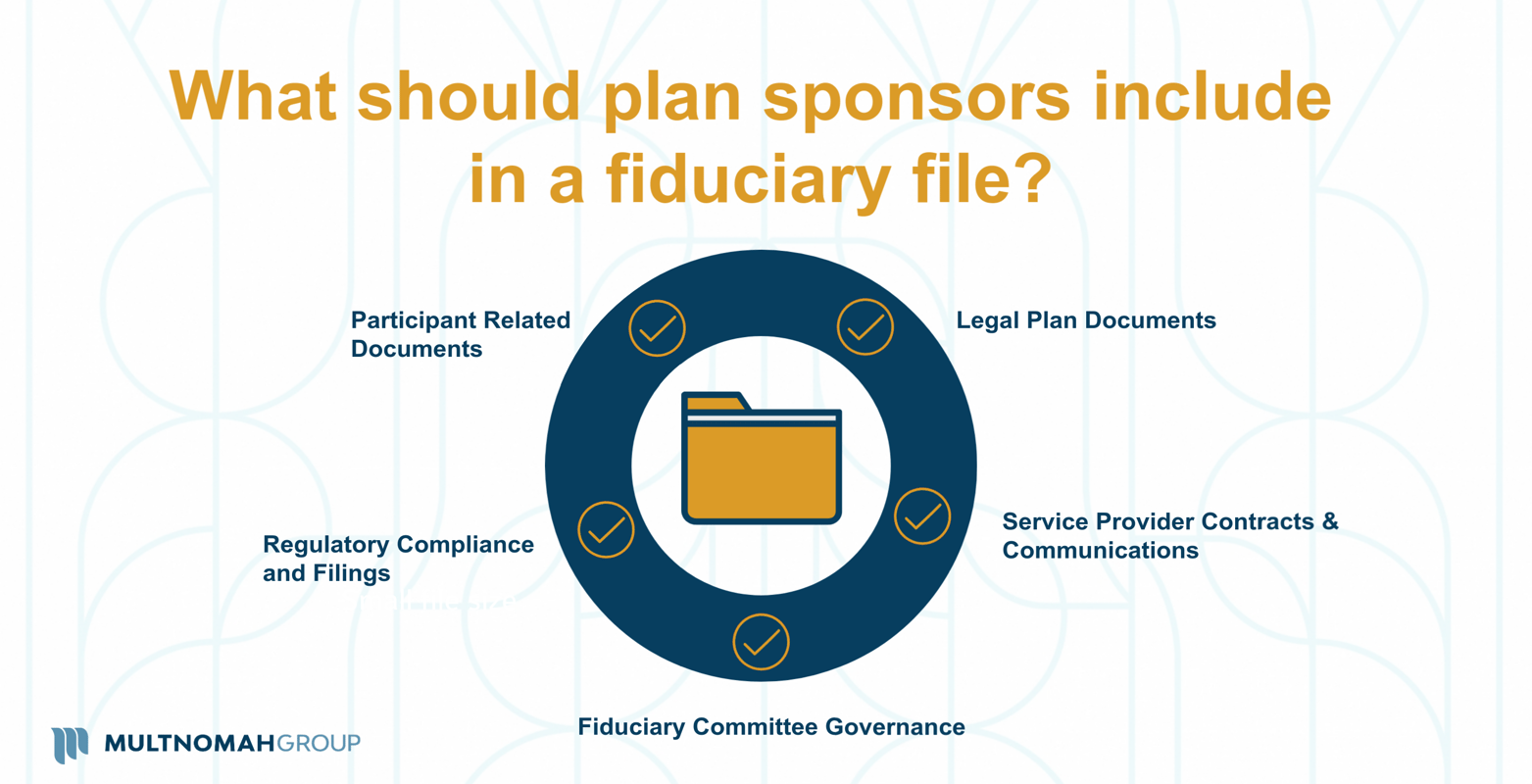

Fiduciary File: What is it and What do you Keep In It?

Read our resource on the five categories of materials a plan sponsor should include in their fiduciary file.

Thought leadership with plan fiduciary education in mind

Read our resource on the five categories of materials a plan sponsor should include in their fiduciary file.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law in December 2019 and contains provisions that seek to expand access to lifetime income within retirement plans. Review those provisions in our fact sheet.

Plan sponsors should review the initiatives outlined within and consider how each initiative may/may not impact their plan(s).

Generally, we believe there are five areas where recordkeeping vendors have tried to monetize their relationship with retirement plans: proprietary investment management, managed accounts, IRA rollovers, cross-selling retail financial products, and annuitization. In this paper, we take a closer look at each of these five approaches.

In this paper, our investment analysts delve into how Multnomah Group conducts the investment manager due diligence that underlies our actively-managed fund recommendations. We cover how we construct actively-managed investment menus and evaluate investment management teams, philosophy and process, and portfolio construction and risk controls.

Forward-thinking, timely updates for retirement plan sponsors.

In this white paper, we take an in-depth look at both 3(21) and 3(38) investment advisors and how to choose which one best suits your company's needs.

Our goal for this guide is to provide a thorough overview of the categories of retirement plan fees and the specific services typically related to each expense for plan fiduciaries.

This Guide seeks to review the current state of the retirement plan industry as it relates to standards of conduct that govern financial professionals.

© 2026 Copyright Multnomah Group Inc.